페이지 정보

본문

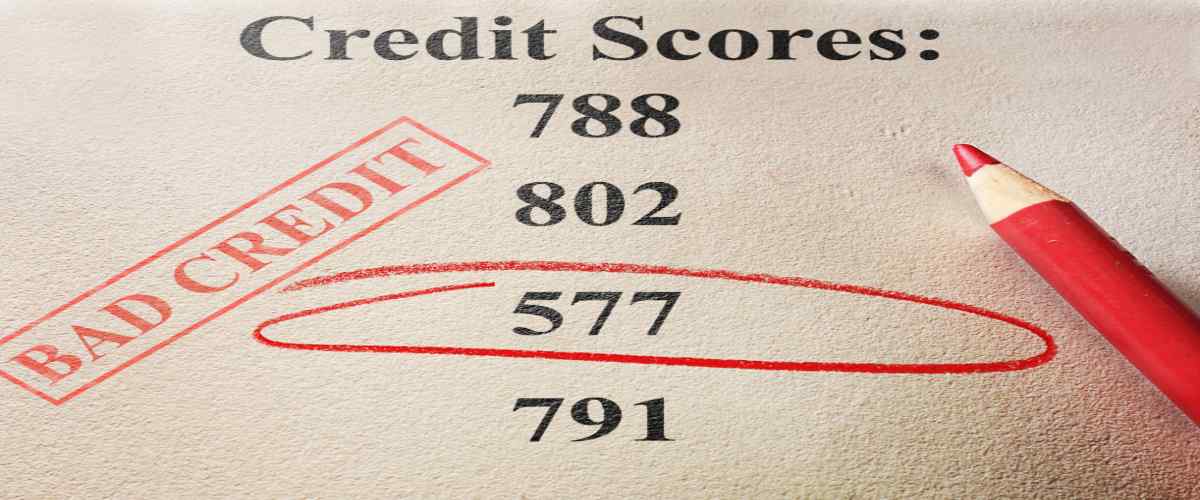

In right now's monetary landscape, individuals with poor credit score histories typically find themselves in a tough place when searching for loans. Conventional lending establishments sometimes rely closely on credit score scores to assess a borrower's risk, making it challenging for these with bad credit to safe financing. However, the emergence of guaranteed bad credit loans with no credit check has offered an alternate for guaranteed Bad credit Loans no credit check a lot of. This text goals to explore the character of these loans, their advantages and disadvantages, and the general implications for borrowers.

Understanding Assured Bad Credit Loans

Assured bad credit loans are financial merchandise designed for individuals with poor credit histories. Not like standard loans, these loans don't require a credit check, allowing borrowers who might in any other case be denied access to funds to acquire financing. Lenders providing these loans typically deal with other components, equivalent to income, employment stability, and the borrower's capacity to repay the loan.

These loans can take various kinds, together with personal loans, payday loans, and installment loans. Every sort has its own phrases, curiosity charges, and repayment structures, however they share the common characteristic of being accessible to those with bad credit.

The Appeal of No Credit Check Loans

The primary enchantment of guaranteed bad credit loans with no credit check lies of their accessibility. For individuals facing financial emergencies or unexpected expenses, these loans can provide quick relief. The appliance process is typically streamlined, allowing borrowers to obtain funds within a brief time frame, usually inside 24 hours.

Additionally, these loans can assist borrowers rebuild their credit score scores if managed responsibly. By making well timed funds, borrowers can demonstrate their creditworthiness, potentially improving their credit score scores over time.

The Risks Involved

While the benefits of guaranteed bad credit loans are obvious, borrowers should additionally bear in mind of the related risks. One of the most vital drawbacks is the high-interest rates typically charged on these loans. Lenders compensate for the increased threat of lending to individuals with bad credit by imposing steep interest rates, which could make repayment difficult.

Furthermore, the lack of a credit score check does not mean that lenders don't assess danger. As an alternative, they could depend on different means, such as earnings verification or bank statements, to determine a borrower's skill to repay. This can result in predatory lending practices, the place borrowers are supplied loans that they can't realistically afford to repay.

Sorts of Guaranteed Bad Credit Loans

- Payday Loans: These are quick-term loans typically due on the borrower's next payday. Whereas they are straightforward to obtain, they often include exorbitantly high-interest rates and charges, making them a risky choice for a lot of borrowers.

- Installment Loans: These loans enable borrowers to repay the amount borrowed in fixed installments over a set period. While they could have lower interest charges than payday loans, they'll still be costly and will lead to a cycle of debt if not managed rigorously.

- Personal Loans: Some lenders provide personal loans to individuals with bad credit, although these should still include increased curiosity rates. The phrases can differ widely, and borrowers ought to fastidiously review the circumstances before committing.

How to choose a Lender

When considering a assured bad credit loan with no credit check, it is crucial to decide on a good lender. Listed here are some suggestions to assist borrowers make informed choices:

- Research Lenders: Search for lenders with constructive critiques and a stable status. Online boards and shopper safety web sites can provide precious insights into a lender's practices.

- Compare Terms: Completely different lenders may provide varying terms, curiosity rates, and charges. It is important to check these components to find the perfect deal.

- Read the Wonderful Print: Earlier than signing any loan settlement, borrowers ought to carefully read the terms and conditions. This consists of understanding the overall price of the loan, repayment schedule, and any potential penalties for late funds.

- Keep away from Predatory Lenders: guaranteed bad credit loans no credit check Be cautious of lenders that use aggressive advertising and marketing tactics or promise guaranteed approval with out assessing your financial state of affairs. These lenders might engage in predatory practices that may result in monetary hardship.

Alternate options to Assured Bad Credit Loans

For people cautious of the risks related to assured bad credit loans, several alternatives could also be value considering:

- Credit Unions: Many credit unions provide personal loans to members, often with extra favorable terms than traditional lenders. They may be more willing to work with people with bad credit.

- Secured Loans: Borrowers can consider secured loans, which require collateral, resembling a vehicle or financial savings account. These loans often come with lower curiosity charges for the reason that lender has a assure of repayment.

- Peer-to-Peer Lending: Online platforms that facilitate peer-to-peer lending can join borrowers with individual traders who may be more versatile of their lending standards.

- Credit Counseling: Searching for guaranteed bad credit loans no credit check recommendation from a credit score counseling service may help individuals develop a plan to improve their credit score and guaranteed bad credit loans no credit check manage their funds successfully.

Conclusion

Assured bad credit loans with no credit check can present a lifeline for individuals facing monetary difficulties. Nonetheless, borrowers must method these loans with caution, understanding the potential risks and costs involved. If you have any issues about the place and how to use guaranteed bad credit loans no credit check, you can speak to us at the web page. By conducting thorough research, comparing lenders, and considering alternative choices, individuals can make knowledgeable decisions that align with their monetary targets. Finally, whereas these loans can supply fast relief, accountable borrowing practices and monetary literacy are essential for lengthy-term stability and success.

댓글목록

등록된 댓글이 없습니다.