페이지 정보

본문

Investing in a Gold Individual Retirement Account (IRA) has turn out to be more and more common amongst buyers seeking to diversify their retirement portfolios and hedge in opposition to inflation. This report aims to offer a comprehensive overview of Gold IRA investing, together with its advantages, risks, and the steps concerned in setting one up.

What is a Gold IRA?

A Gold IRA is a sort of self-directed Individual Retirement Account that enables investors to carry bodily gold and different valuable metals as part of their retirement savings. In contrast to conventional IRAs, which sometimes hold stocks, bonds, and mutual funds, a Gold IRA provides buyers the chance to put money into tangible property. This can include gold bullion, coins, silver, platinum, and palladium.

Benefits of Gold IRA Investing

- Inflation Hedge: Gold has historically been seen as a secure haven during economic uncertainty. When inflation rises, the worth of foreign money often declines, making gold a desirable asset to preserve purchasing energy.

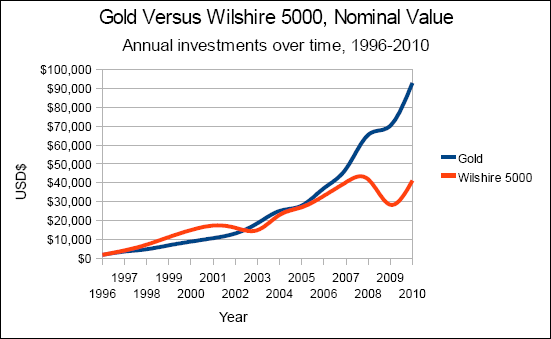

- Diversification: Including gold in a retirement portfolio can cut back total threat. Gold typically moves inversely to stocks and bonds, which means that when the stock market is down, gold costs may rise, offering a cushion in opposition to market volatility.

- Tangible Asset: In contrast to paper property, gold is a physical commodity. Traders can hold their investment of their palms, providing a sense of security that digital belongings can't.

- Tax Advantages: Gold IRAs provide the identical tax benefits as traditional IRAs. Contributions could also be tax-deductible, and investments grow tax-deferred till withdrawals are made during retirement.

- Wealth Preservation: Gold has maintained its value over centuries, making it a dependable store of wealth. Many traders turn to gold to protect their belongings from financial downturns and foreign money devaluation.

Dangers of Gold IRA Investing

- Market Volatility: Whereas gold is commonly seen as a protected haven, its worth may be unstable in the brief time period. Investors should be prepared for fluctuations in value.

- Storage and Insurance coverage Prices: Physical gold should be stored in a secure location, which can incur additional costs. Buyers might must pay for storage charges and insurance coverage to protect their belongings.

- Limited Progress Potential: Not like stocks, gold doesn't generate earnings or dividends. Investors searching for development might discover gold less appealing in comparison with different asset courses.

- Regulatory Concerns: Gold IRAs are topic to IRS laws, and buyers must be sure that their investments adjust to these guidelines to avoid penalties.

- Charges and Costs: Establishing a Gold IRA often involves varied charges, together with setup charges, upkeep charges, and transaction fees. These can eat into investment returns if not managed correctly.

Easy methods to Set up a Gold IRA

Establishing a Gold IRA involves several steps:

- Select a Custodian: The IRS requires that each one IRAs, together with Gold IRAs, be held by a professional custodian. Research and select a good custodian skilled in dealing with precious metals.

- Open an Account: After getting chosen a custodian, you'll be able to open your Gold IRA account. This course of usually includes finishing paperwork and offering identification.

- Fund Your Account: You may fund your Gold IRA by a rollover from an current retirement account, a direct transfer, or a new contribution. Remember of contribution limits and tax implications.

- Choose Your Valuable Metals: Work together with your custodian to choose the sorts of gold and different valuable metals you want to spend money on. Be certain that the metals meet IRS requirements for purity and high quality.

- Buy and Retailer Your Gold: reliable firms for investing in gold iras After selecting your metals, your custodian will facilitate the acquisition and arrange for secure storage. Gold must be stored in an IRS-permitted depository.

- Monitor Your Funding: Often review your Gold IRA to assess its efficiency and make changes as wanted. Stay knowledgeable about market trends and economic conditions which will impact gold prices.

Sorts of Valuable Metals Allowed in a Gold IRA

The IRS has particular guidelines regarding which varieties of valuable metals might be included in a Gold IRA. Eligible metals should meet sure purity requirements:

- Gold: Should be at least 99.5% pure (e.g., American Gold Eagle coins, Canadian Gold Maple Leaf coins).

- Silver: Have to be no less than 99.9% pure (e.g., American Silver Eagle coins).

- Platinum: Must be a minimum of 99.95% pure.

- Palladium: Have to be no less than 99.95% pure.

Conclusion

Gold IRA investing could be a invaluable addition to a retirement portfolio, offering benefits comparable to diversification, inflation safety, and the safety of tangible assets. Nonetheless, it is important for investors to know the dangers concerned and the regulatory necessities that govern Gold IRAs. By fastidiously considering these components and following the required steps to set up a Gold IRA, buyers can take advantage of the potential advantages of investing in gold and other treasured metals as a part of their long-time period retirement technique. If you adored this short article and you would like to receive additional facts relating to reliable firms for investing in gold iras kindly browse through the site. As with any funding, it's advisable to seek the advice of with a financial advisor to make sure that a Gold IRA aligns with your total financial objectives and risk tolerance.

댓글목록

등록된 댓글이 없습니다.