페이지 정보

본문

Gold has long been thought of a symbol of wealth and a safe-haven investment, notably in instances of economic uncertainty. Because of this, the demand for gold has remained constantly excessive, resulting in a wide range of choices for customers looking to buy this valuable steel. This observational analysis article aims to discover the most effective places to buy gold, focusing on the benefits and disadvantages of each choice, as nicely because the elements that shoppers ought to consider when making a purchase order.

1. Native Jewellery Shops

Local jewellery stores are sometimes the primary place individuals consider when contemplating purchasing gold. These institutions usually offer a variety of gold items, including rings, necklaces, and bracelets. One in all the primary advantages of buying gold from an area jewelry retailer is the flexibility to see and contact the gadgets earlier than making a purchase. This tactile experience allows shoppers to assess the standard, craftsmanship, and design of the gold items.

However, costs at local jewelry stores will be increased than other purchasing options attributable to markups from design and craftsmanship. Additionally, shoppers should be cautious concerning the purity of the gold being sold, as some stores may provide decrease-quality gold at premium costs. It is essential to ask for certification to ensure the gold's authenticity.

2. On-line Retailers

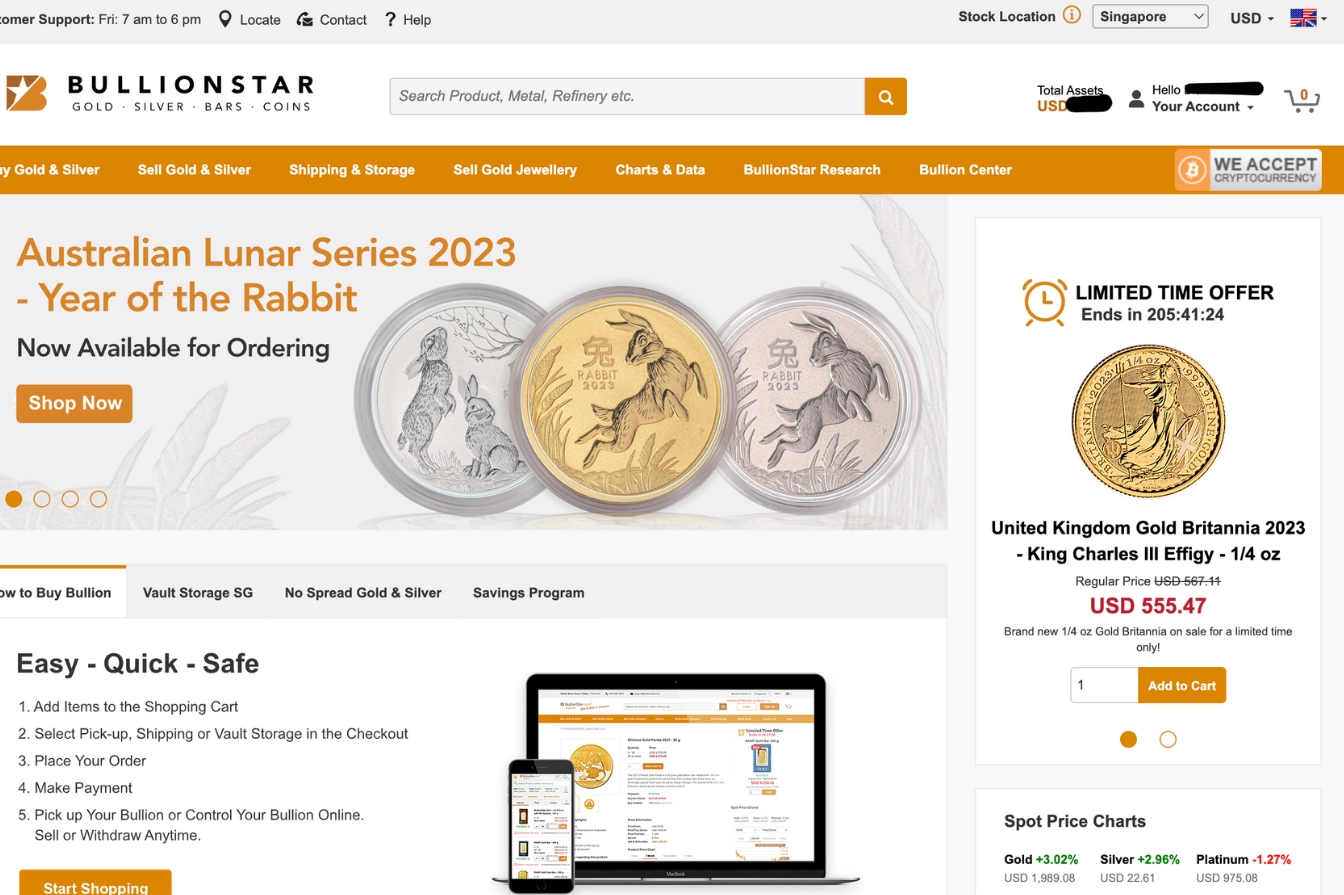

The rise of e-commerce has transformed the best way individuals buy gold. On-line retailers, akin to APMEX, JM Bullion, and GoldSilver, provide a handy platform for buying gold bullion, coins, and jewellery. Certainly one of the numerous benefits of buying gold online is the aggressive pricing. On-line retailers often have lower overhead costs compared to brick-and-mortar shops, allowing them to go on savings to clients.

Moreover, online platforms sometimes supply a wider selection of merchandise, together with varied gold coins and bars from different mints worldwide. Nonetheless, consumers must train warning when buying gold online. It is essential to research the retailer's status, learn buyer critiques, and examine for safe cost choices. Moreover, consumers ought to remember of transport prices and insurance coverage, best place to buy gold which may add to the general expense.

3. Coin Shops

Coin shops are specialized retailers that target shopping for and selling coins, together with gold coins. These institutions usually have knowledgeable staff who can present worthwhile insights into the gold market, best place to buy gold helping shoppers make knowledgeable decisions. If you cherished this article and also you would like to collect more info with regards to www.9i1b4dy00ap2m.kr i implore you to visit our internet site. Coin retailers may be a superb source for buying gold coins, which might carry historic significance and numismatic worth in addition to their gold content.

Considered one of the benefits of shopping for from a coin store is the potential for negotiation. Unlike larger retailers, coin outlets could also be extra willing to debate costs, especially for bulk purchases. Nevertheless, consumers should be cautious in regards to the authenticity of the coins and guarantee they're buying from a good vendor. Moreover, coin shops might have restricted stock compared to on-line retailers.

4. Gold Exchanges and Auctions

Gold exchanges and auctions are another option for buying gold, significantly for those looking for distinctive or rare pieces. Auctions can provide alternatives to acquire gold gadgets at aggressive costs, particularly if there is limited bidding competitors. Furthermore, gold exchanges enable consumers to commerce their gold items, which can be a pretty choice for these trying to upgrade their collection.

Nevertheless, buying gold at auctions requires a eager understanding of the market and the precise gadgets being sold. It is essential to analysis the auction house's reputation and understand the terms and circumstances earlier than participating. Additionally, buyers should bear in mind that auction prices can fluctuate significantly, and there is no such thing as a guarantee of securing a good deal.

5. Gold Mining Corporations

Investing in gold mining corporations is another avenue for these looking to realize publicity to gold with out immediately purchasing the steel. By shopping for shares in these companies, buyers can benefit from the appreciation of gold prices not directly. This feature can be particularly interesting for many who want a extra fingers-off investment method.

However, investing in gold mining firms comes with its own set of risks. The performance of those corporations is influenced by numerous components, together with operational efficiency, management decisions, and geopolitical occasions. Therefore, it is crucial for traders to conduct thorough research and consider diversifying their portfolios to mitigate risks.

6. Gold ETFs and Mutual Funds

For those who prefer a extra diversified funding method, gold exchange-traded funds (ETFs) and mutual funds offer an excellent option. These monetary merchandise enable buyers to achieve exposure to gold without the necessity to physically hold the steel. Gold ETFs sometimes observe the value of gold and provide a convenient method to invest within the commodity.

Certainly one of the first advantages of investing in gold ETFs and mutual funds is liquidity. Investors can simply purchase and sell shares on the stock market, making it a flexible option. Additionally, these funds often have decrease administration charges in comparison with conventional mutual funds. Nonetheless, buyers should be aware of the risks involved, together with market volatility and management selections that may impact efficiency.

Conclusion

In conclusion, the best place to buy gold will depend on individual preferences, investment objectives, and threat tolerance. Native jewellery stores offer a private contact and the flexibility to assess high quality in person, whereas online retailers present competitive pricing and a wider choice. Coin outlets may be an excellent supply for collectors, and auctions may yield unique finds for those prepared to navigate the bidding course of. For traders looking for indirect publicity to gold, mining companies and ETFs current viable choices.

Finally, consumers ought to conduct thorough analysis, consider their budget, and understand the market dynamics before making a purchase order. Whether or not buying gold for personal adornment, funding, or assortment, informed choice-making is essential to a profitable transaction within the gold market.

댓글목록

등록된 댓글이 없습니다.