페이지 정보

본문

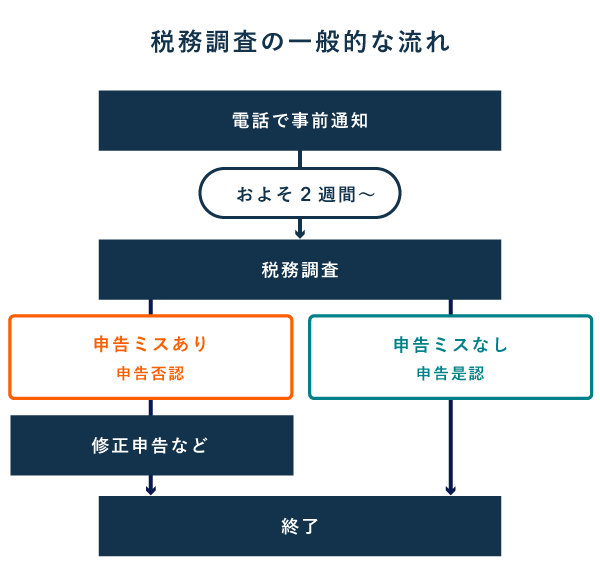

Pre-Audit Notification and Preparation

Before the tax authority commences an audit, the taxpayer may receive a notification in the form of a letter or a phone call or via email stating the reason for the audit and the type of financial records that will be reviewed. Once notified, it is essential for the taxpayer to take immediate action to prepare for the audit, which requires gathering all relevant financial documents, such as receipts, 税務調査 税理士 費用 invoices, and bank statements.

The taxpayer should also familiarize themselves with the applicable tax laws and regulations, as well as any relevant tax authority guidelines to avoid disputes. It may also be beneficial to consult with a tax professional, such as a certified public accountant (CPA) or a tax attorney, to guide the taxpayer through the audit process and provide expert advice and guidance.

Tax Authority Audit Process

The tax authority audit process involves a comprehensive review of the taxpayer's financial records to ensure that they comply with tax laws and regulations, including reviewing financial statements and examining specific transactions or expenditures. The taxpayer may be required to provide additional information or documentation to support their tax returns, which can be complicated to prepare and submit.

The taxpayer may also be required to submit to an in-person or video conference interview with the tax authority representative, who will examine and question the taxpayer's financial records and documentation.

Common Issues That Arise During an Audit

There are several common issues that can arise during a tax authority audit, such as:

- Inconsistencies or discrepancies in the taxpayer's financial records

- Lack of documentation or incomplete documentation for specific transactions or expenditures

- Failure to report income or claim deductions to which the taxpayer is not entitled, resulting in financial losses

- Use of accounting methods or techniques that do not comply with tax laws and regulations, leading to complications and disputes.

Dispute Resolution Process

If the taxpayer disagrees with the tax authority's findings or conclusions, they may be able to dispute the matter through a formal dispute resolution process, which involves an appeal or complaint.

The taxpayer may need to provide additional evidence or documentation to support their position, and may be required to attend a hearing or trial to present their case, which can be a lengthy and costly process. The dispute resolution process can result in a more favorable outcome for the taxpayer, but may also draw out in time.

Tips for Resolving Tax Disputes

To resolve tax disputes effectively, the taxpayer should:

- Keep accurate and detailed financial records, which will assist the resolution process

- Maintain open communication with the tax authority representative, who can assist and advise

- Seek the guidance of a tax professional, who can advise on tax matters

- Be prepared to provide additional documentation or evidence to support their position, which can proof their claim.

- Consider seeking the assistance of a tax attorney if the dispute is complex or involves intentional tax evasion, which can result in a favorable outcome.

댓글목록

등록된 댓글이 없습니다.