페이지 정보

본문

Investing in gold has been a time-honored technique for preserving wealth and hedging against inflation. With the rise of self-directed retirement accounts, gold IRAs have turn out to be increasingly popular among buyers seeking to diversify their portfolios. This article will discover what a gold IRA kit is, its advantages, gold ira investment for safe retirement how to set one up, and gold ira investment for safe retirement the issues to keep in mind.

What's a Gold IRA Kit?

A gold IRA kit is a comprehensive bundle that provides investors with the required tools and knowledge to arrange a gold Individual Retirement Account (IRA). This package usually consists of educational materials, varieties, and resources to help individuals perceive the process of investing in gold inside a retirement account. Gold IRAs allow individuals to hold bodily gold, silver, platinum, and palladium in a tax-advantaged account, unlike traditional IRAs that sometimes hold stocks, bonds, and mutual funds.

Advantages of a Gold IRA

- Diversification: Gold has traditionally had a low correlation with conventional asset lessons like stocks and bonds. By together with gold in your retirement portfolio, you'll be able to hedge in opposition to market volatility and economic downturns.

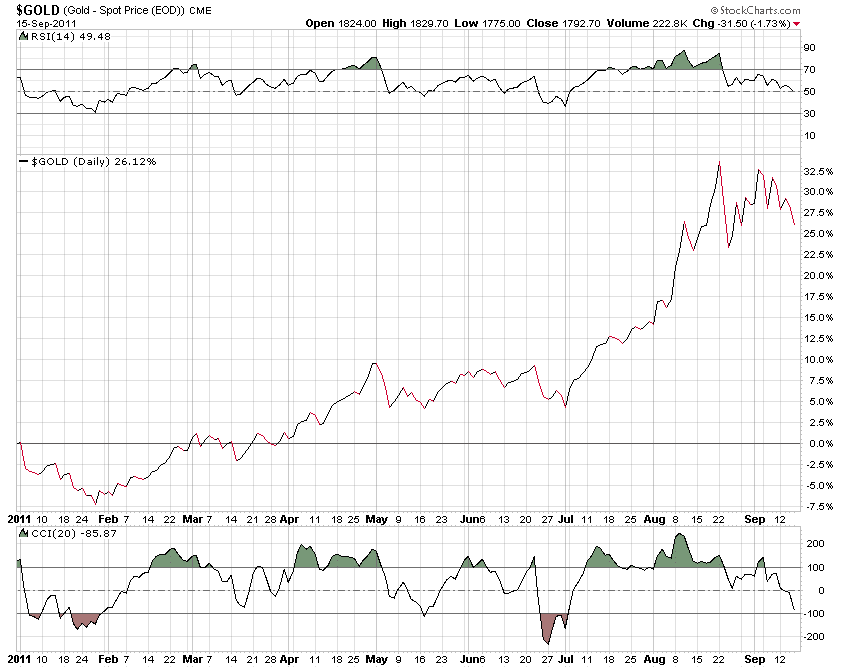

- Inflation Hedge: Gold is usually seen as a protected haven during instances of inflation. When the value of currency declines, gold tends to retain its buying power, making it a dependable store of worth.

- Tax Advantages: Like other IRAs, gold IRAs supply tax-deferred growth. This implies you will not pay taxes on the good points from your gold investments until you withdraw funds out of your account in retirement.

- Safety Against Currency Devaluation: In times of financial uncertainty, currencies can lose worth. Gold, being a tangible asset, can provide a safeguard against forex fluctuations.

- Long-Time period Growth Potential: Traditionally, gold has appreciated over the long run. While it may be unstable within the brief term, many investors view it as a strong long-term investment.

Setting up a Gold IRA

Establishing a gold IRA involves a number of steps, and a gold IRA kit can streamline this process. Here’s a step-by-step information:

- Select a Custodian: Step one in setting up a gold IRA is deciding on a custodian. A custodian is a financial establishment that manages your IRA and ensures compliance with IRS laws. Search for a custodian that focuses on precious metals and has a very good fame.

- Open an Account: Once you’ve chosen a custodian, you’ll have to open a self-directed IRA account. This sometimes entails filling out an software and providing identification and financial info.

- Fund Your Account: You possibly can fund your gold IRA via varied means, including rolling over funds from an existing retirement account or making a direct contribution. Bear in mind of contribution limits and rollover laws.

- Order Your Gold: After funding your account, you may buy gold by way of your custodian. Your gold should meet IRS requirements for purity and have to be stored in an approved depository.

- Select a Storage Choice: Your gold have to be saved in a safe location. Most custodians offer storage options in IRS-authorised depositories. This ensures that your funding is secure and compliant with IRS regulations.

- Complete Required Documentation: Your gold IRA kit will include the required kinds and documents required to complete your investments. For more info regarding https://Ukcarers.co.uk/employer/gold-ira-rollover-guide/ visit our own web-page. Ensure that all paperwork is filled out accurately to keep away from any points together with your account.

Varieties of Valuable Metals Allowed in a Gold IRA

Whereas gold is the primary focus of a gold IRA, you may as well put money into different treasured metals. The IRS allows the following metals in a gold IRA:

- Gold: Must be 99.5% pure or larger.

- Silver: Have to be 99.9% pure or larger.

- Platinum: Have to be 99.95% pure or larger.

- Palladium: Should be 99.95% pure or higher.

Considerations When Investing in a Gold IRA

- Fees: Gold IRAs often include various charges, together with setup fees, annual upkeep fees, and storage fees. Ensure to know the fee construction of your chosen custodian earlier than proceeding.

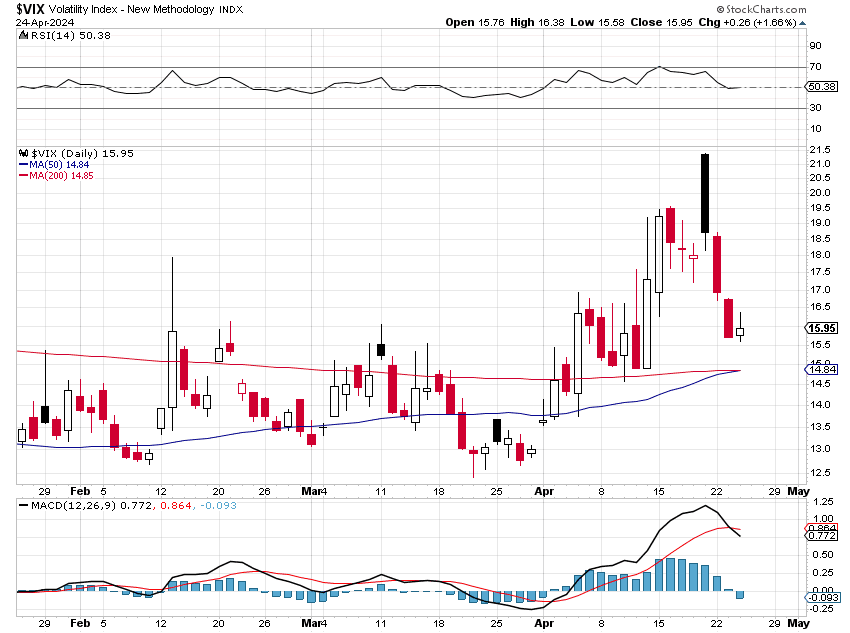

- Market Volatility: Whereas gold is considered a stable investment, it could possibly nonetheless experience price fluctuations. Be ready for potential quick-time period volatility in your funding.

- Liquidity: Promoting bodily gold can take time and is probably not as straightforward as selling stocks. Consider your liquidity wants earlier than investing heavily in gold.

- IRS Laws: Guarantee that you simply understand the IRS regulations concerning gold IRAs. Non-compliance can lead to penalties and tax implications.

- Investment Horizon: Gold is usually seen as a long-term investment. Consider your retirement timeline and the way gold suits into your general investment strategy.

Conclusion

A gold IRA kit generally is a beneficial resource for those trying to diversify their retirement portfolios with treasured metals. By understanding the advantages, setting up the account, and being aware of the related issues, buyers could make informed decisions about incorporating gold into their retirement strategy. As with any funding, it’s essential to do thorough analysis and consult with financial advisors to ensure that a gold IRA aligns along with your financial goals and danger tolerance. With the proper method, a gold IRA could be a robust software for wealth preservation and progress in your retirement years.

댓글목록

등록된 댓글이 없습니다.